This article provided courtesy of Kevin Bader, MCM Capital Partners

“What is the value of my business?” This is a common question asked by business owners for estate planning or retirement purposes since, in many cases, most of their wealth is tied up in their business. The definitive means of establishing a company’s true value requires soliciting bids from qualified buyers. However, short of putting your company up for sale, this article describes a relatively simple means of approximating the value of a private company.

The total fair market value of a business is called its Enterprise Value, or the sum of a company’s market value inclusive of its debts, minus its cash and cash equivalents. There are various methods to calculate Enterprise Value including, but not limited to, discounted cash flow analysis, using public company comparables or applying recent industry transactions. A valuation approach commonly used by private equity and investment banking professionals, and the one we will discuss herein, applies a multiple (“the Multiple” or “Multiple”) to Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”).

The majority of businesses generating between $10 million and $75 million of annual revenue historically transact for multiples between 5.0x and 8.0x EBITDA. The appropriate Multiple to use in calculating Enterprise Value is dependent on numerous critical factors discussed below.

What Multiple Should I Use?

The appropriate EBITDA Multiple in calculating Enterprise Value is influenced by numerous factors including, but not limited to, level of customer concentration, company and industry growth rates, profit margins, size of the company and strength of the management team. Such factors need to be assessed individually and considered in totality when determining the appropriate EBITDA Multiple. For example, customer concentration (e.g., single customer > 20%) often dictates a lower EBITDA Multiple. Conversely, companies with little customer concentration participating in attractive end markets such as medical or aerospace, or utilizing unique materials or processes, typically command higher than average Multiples.

What EBITDA Should I Use?

It is common practice to utilize the most recent trailing twelve months EBITDA in calculating Enterprise Value, albeit in certain circumstances it may be more appropriate to use an average EBITDA of the last 2 or 3 years in the calculation. For example, if the company has experienced a temporary spike or dip in EBITDA due to, e.g., a customer or market issue, an average EBITDA may be more appropriate.

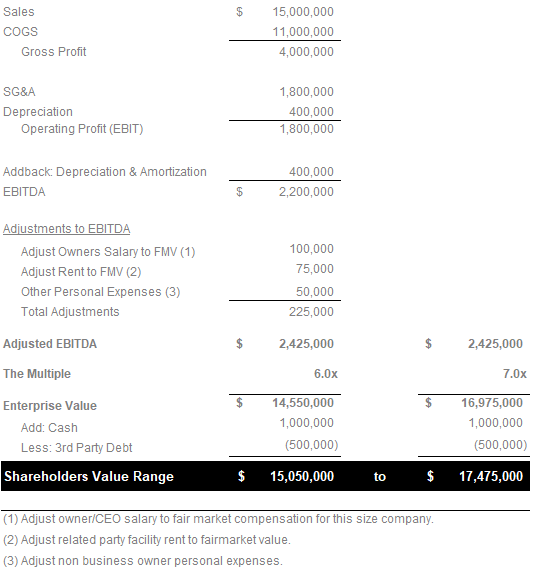

Further, it is common practice to normalize EBITDA, resulting in a term called “Adjusted EBITDA.” Adjustments to EBITDA include non-recurring revenues and expenses (e.g., litigation expenses, changes in accounting methods, certain professional fees, etc.), non-business/personal-related expenses (e.g., car leases not used in business, payments to family members outside the business, country club memberships etc.), facility rent and/or owner compensation above or below fair market value. EBITDA adjustments likely not accepted by the buyer are ineffective marketing campaigns, research and development expenses related to failed product launches or bonuses paid annually but considered “discretionary.”

Understanding the Difference Between Enterprise Value and Shareholders Value

The product of using a multiple of EBITDA results in an estimate of Enterprise Value, not to be confused with Shareholders Value. Since businesses typically transact on a cash-free, debt-free basis, Shareholders Value is calculated as the Enterprise Value (i.e., Multiple x Adjusted EBITDA) plus cash and cash equivalents minus third party debt (e.g. bank debt and capital leases).

The following example merely illustrates how to calculate Enterprise Value using the Multiple of EBITDA method from the foregoing concepts:

Summary

This article has provided the framework for calculating a company’s estimated Enterprise Value whose true value can only be established by soliciting bids from qualified buyers. However, it is possible to provide a reasonably close approximation of Enterprise Value with the help of a qualified professional who can assist in identifying and quantifying critical valuation factors.

The next article explores our view on critical factors affecting Enterprise Value including:

- EBITDA Size

- Revenue Trends

- Profit Margins

- Customer Concentration

- Industry Growth Rate

- Strength & Depth of the Management Team

- Competitive Advantages

Is your business creating maximum value?

Complete the “Value Builder” questionnaire today in just 13 minutes and we’ll send you a 27-page custom report assessing how well your business is positioned for selling. Take the test now: