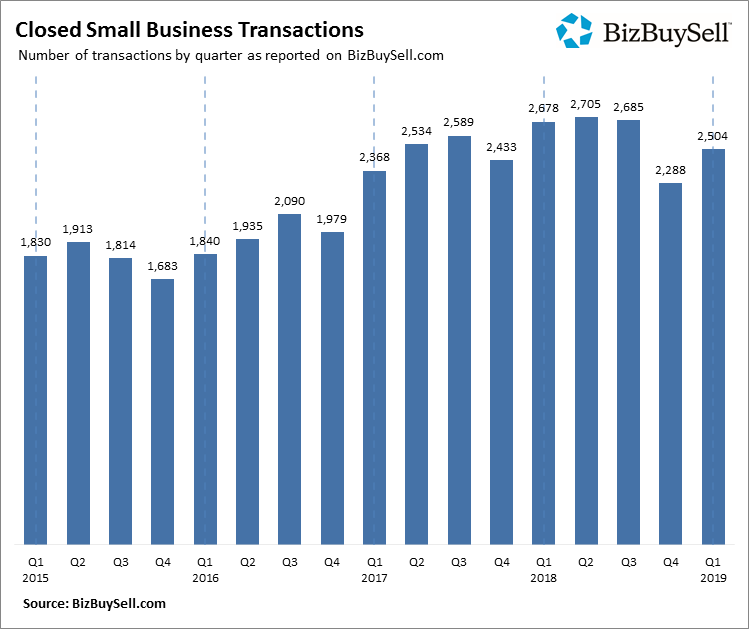

Small business transactions in the first quarter of 2019 experienced a modest year-over-year decline but remain at historically high levels, according to the latest BizBuySell Insight Report, a nationally recognized economic indicator that aggregates statistics from business-for-sale transactions reported by participating business brokers nationwide. A total of 2,504 sold businesses were reported in the first three months of 2019, a 6.5% decline from the same period last year. Similarly, Q4 2018 saw a 6% decrease from the same quarter in 2017.

It is important to note that both 2017 and 2018 set new records for the most annual small business transactions since BizBuySell started reporting the data in 2007. So while reported deals are down slightly from a year ago, the market continues to be very active compared to the previous decade. In fact, Q1 2019 represents the second highest first quarter on record, trailing only 2018. It is too early to tell if the recent plateau marks any kind of market shift or not. To gain additional perspective, BizBuySell also surveyed business owners and some leading brokers, the results of which are incorporated within this report.

A number of factors could be tempering the strong transaction growth rates seen in recent years. Most notably, these include the recent government shutdown, low unemployment, record profits, deal financing, and general uncertainty around the impact of administration policies relating to tariffs, immigration, and health care.

“Main Street business sales may have been impacted in part due to a stronger economy where individuals are more satisfied as employees (not looking to purchase businesses) and business owners are seeing higher profits (not looking to sell their businesses)”, said Jeff Snell, Chairman of the International Business Broker Association, the industry’s leading trade group. “Also, time to complete business transactions has increased marginally, potentially as a result of the Federal Government budget shut down which closed SBA loan guarantee processing offices. However, broker optimism through 2019 remains strong”, Snell added.

“The business sale market still continues to perform strong in 2019 in terms of number of deals getting done and the multiples sellers are receiving. However, we are seeing signs that the market could become more challenging in the future with interest rates rising and financing becoming both more expensive and harder to acquire. This can make the buyer process lengthy and more difficult, which would suppress multiples and extend time to close”, said Jessica Fialkovich, President, Transworld Business Advisors of Denver.

Of course, it is also possible the past two quarters have been outliers and 2019 will continue on its multi-year growth trend in upcoming quarters. It is something to watch closely as data comes in over the rest of the year. Inventory remains strong, with a 6.1% increase in listings in Q1 over the same quarter last year.

“After several years of record activity, it’s good to see that there are still plenty of listings coming on to the market, so the small decrease in activity may be more about buyers taking a cautious approach than a slowdown in the supply,” Bob House, President of BizBuySell.com & BizQuest.com, said.

Is now the time to consider selling your business?

Complete the “Value Builder” questionnaire today in just 13 minutes and we’ll send you a 27-page custom report assessing how well your business is positioned for selling. Take the test now: